Delve into the world of small business accounting software inventory management, where we’ll explore the essentials of managing your finances and inventory seamlessly. Get ready to optimize your operations and drive your business to new heights.

Discover the benefits and key features of accounting software tailored for small businesses, and learn how to effectively manage your inventory to maximize efficiency and profitability.

Small Business Accounting Software

Small business accounting software is a valuable tool for managing the financial aspects of a small business. It automates many accounting tasks, saving time and reducing errors. It also provides insights into the financial health of a business, helping owners make informed decisions.

There are many different small business accounting software programs available, so it is important to choose one that meets the specific needs of a business. Some of the key features to look for include:

- Ease of use: The software should be easy to learn and use, even for those with no accounting experience.

- Functionality: The software should have the features needed to manage the financial aspects of a business, such as invoicing, billing, and expense tracking.

- Affordability: The software should be affordable for a small business budget.

Some popular small business accounting software programs include:

- QuickBooks

- Xero

- FreshBooks

Inventory Management for Small Businesses: Small Business Accounting Software Inventory Management

Inventory management is crucial for small businesses as it helps them track, control, and optimize their inventory levels to meet customer demand efficiently while minimizing waste and maximizing profits.

There are several methods of inventory management, each with its own advantages and disadvantages:

- First-in, first-out (FIFO): This method assumes that the oldest inventory is sold first. It is simple to implement and can help businesses avoid spoilage or obsolescence of inventory.

- Last-in, first-out (LIFO): This method assumes that the newest inventory is sold first. It can be beneficial for businesses that want to defer tax payments or reduce the impact of inflation on their inventory value.

- Weighted average cost: This method calculates the average cost of inventory based on the cost of all units purchased over a period of time. It is often used by businesses that have a high volume of inventory or frequent price fluctuations.

Best Practices for Effective Inventory Management

To effectively manage inventory, small businesses should:

- Establish clear inventory policies and procedures: This includes defining who is responsible for inventory management, how inventory is tracked, and how inventory levels are replenished.

- Use inventory management software: This can help businesses automate inventory tracking, generate reports, and optimize inventory levels.

- Conduct regular inventory audits: This helps businesses identify discrepancies between their physical inventory and their records, and make necessary adjustments.

- Monitor inventory turnover: This metric measures how quickly inventory is being sold and replaced. A high inventory turnover rate indicates that inventory is being managed efficiently, while a low inventory turnover rate may indicate overstocking or slow sales.

- Implement just-in-time (JIT) inventory management: This approach aims to minimize inventory levels by ordering inventory only when it is needed. JIT can help businesses reduce storage costs and improve cash flow.

Integrating Accounting Software with Inventory Management

Integrating accounting software with inventory management streamlines business operations and provides several advantages, including improved accuracy, enhanced efficiency, and better decision-making.

Integrating accounting and inventory management systems involves:

- Establishing a connection between the two systems

- Mapping data fields to ensure seamless flow of information

- Testing the integration to ensure accuracy and functionality

Software Solutions for Integrated Accounting and Inventory Management

Numerous software solutions offer integrated accounting and inventory management capabilities, including:

- QuickBooks Online

- Sage 50cloud

- NetSuite

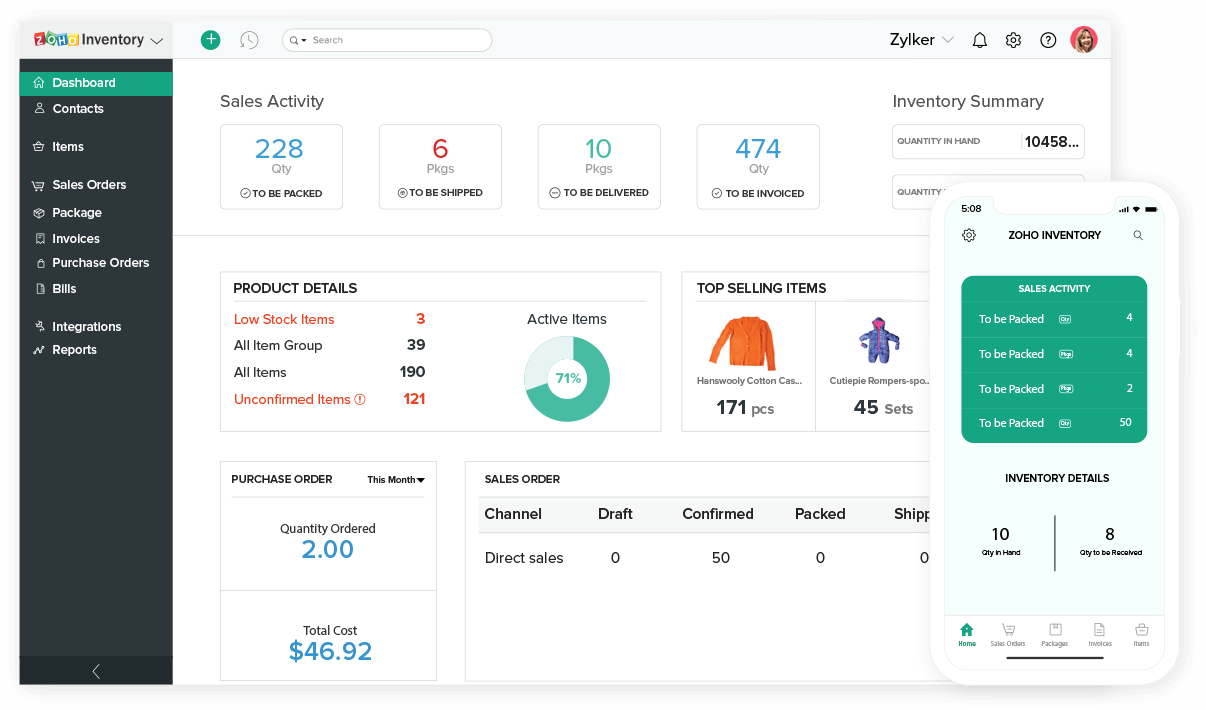

- Zoho Inventory

- ShopKeep

Best Practices for Small Business Accounting and Inventory Management

Effective accounting and inventory management are crucial for the success of small businesses. Implementing best practices can streamline operations, improve efficiency, and enhance financial performance.

Comparative Analysis of Accounting Software and Inventory Management Features

Understanding the distinct features of accounting software and inventory management systems is essential for seamless integration and efficient management.

| Accounting Software | Inventory Management |

|---|---|

| Income and expense tracking | Stock level monitoring |

| Financial reporting | Reorder point alerts |

| Payroll processing | Barcoding and scanning |

| Tax calculations | Warehouse management |

| Customer invoicing | Lot tracking |

Tips for Optimizing Accounting and Inventory Management Processes, Small business accounting software inventory management

By implementing the following tips, small businesses can optimize their accounting and inventory management processes, resulting in increased accuracy, efficiency, and cost savings:

- Automate tasks: Use software to automate repetitive tasks such as data entry and invoicing.

- Establish clear inventory management policies: Define procedures for receiving, storing, and issuing inventory to prevent errors and loss.

- Regularly reconcile accounts: Reconcile bank statements, inventory records, and accounting software to ensure accuracy and prevent fraud.

- Implement inventory control measures: Use tools such as barcodes, RFID tags, and cycle counting to track inventory levels and minimize shrinkage.

- Monitor key performance indicators (KPIs): Track metrics such as inventory turnover, gross profit margin, and days sales outstanding (DSO) to identify areas for improvement.

Common Challenges Faced by Small Businesses in Managing Accounting and Inventory

Small businesses often face specific challenges in managing accounting and inventory effectively:

- Limited resources: Small businesses often have limited staff and financial resources, making it difficult to invest in comprehensive accounting and inventory management systems.

- Lack of expertise: Small business owners may not have the necessary accounting or inventory management expertise, leading to errors and inefficiencies.

- Manual processes: Manual processes can be time-consuming, prone to errors, and difficult to scale as the business grows.

- Data integration: Integrating accounting and inventory management systems can be complex, requiring technical expertise and specialized software.

Final Conclusion

By integrating accounting software with inventory management, you’ll gain a comprehensive view of your business’s financial health and stock levels. Implement best practices and overcome common challenges to streamline your operations and stay ahead of the competition.

Questions and Answers

What are the key benefits of using accounting software for small businesses?

Accounting software automates tasks, improves accuracy, provides financial insights, and simplifies tax preparation.

How does inventory management help small businesses?

Inventory management helps businesses track stock levels, optimize ordering, reduce waste, and improve customer satisfaction.

What are the challenges small businesses face in managing accounting and inventory?

Challenges include limited resources, manual processes, and lack of integration between systems.