Accounting and inventory software for small businesses takes center stage in this captivating narrative, inviting readers to delve into a realm of intricate details and unparalleled innovation from the very first word. Prepare to be enthralled as we unravel the tapestry of this essential tool, exploring its multifaceted benefits and the transformative impact it has on small businesses.

This comprehensive guide delves into the heart of accounting and inventory software, providing a clear and comprehensive overview of its features, types, and the crucial considerations for choosing the perfect solution for your business. Discover the seamless integration possibilities, the importance of security and compliance, and the pricing and support options that align with your specific needs.

Introduction to Accounting and Inventory Software: Accounting And Inventory Software For Small Business

Accounting and inventory software is a valuable tool for small businesses to manage their financial and inventory operations efficiently. It automates tasks, improves accuracy, and provides real-time insights into the business’s financial performance and inventory levels.

Key Features and Functionalities

Accounting and inventory software typically includes a range of features and functionalities to meet the specific needs of small businesses, such as:

- Accounting: Accounts payable and receivable, invoicing, financial reporting, and tax preparation.

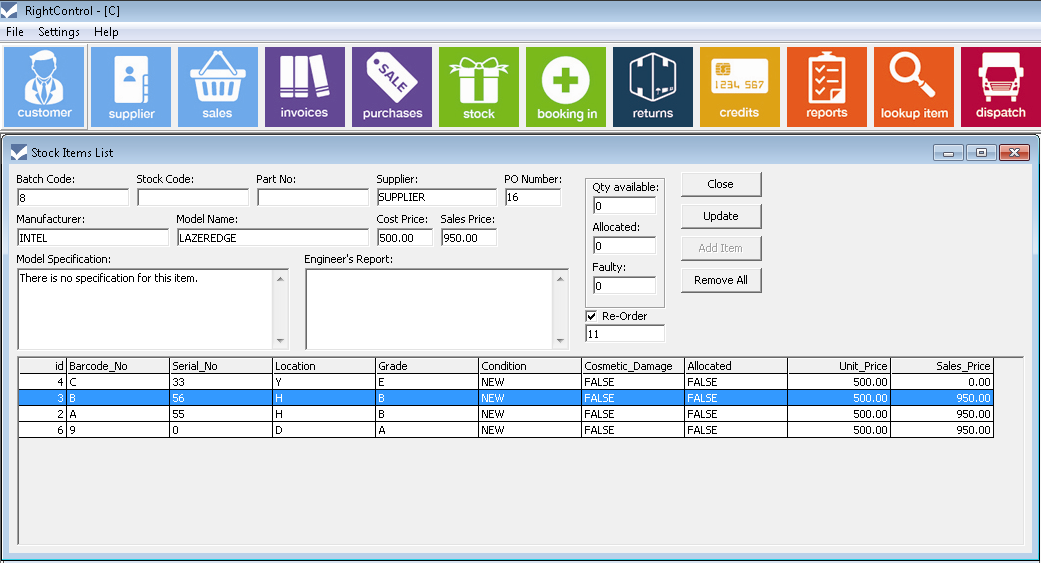

- Inventory Management: Inventory tracking, stock level monitoring, purchase order management, and barcode scanning.

- Reporting and Analytics: Customizable reports and dashboards to track key metrics and make informed decisions.

- Integration with other systems: Seamless integration with other business applications, such as CRM and e-commerce platforms.

- Mobile access: Ability to access the software remotely from smartphones or tablets.

By leveraging these features, small businesses can streamline their accounting and inventory processes, improve their financial accuracy, and gain valuable insights to make better business decisions.

Types of Accounting and Inventory Software

Accounting and inventory software can be classified into two main types: cloud-based and on-premise solutions.

Cloud-based accounting and inventory software is hosted on a remote server and can be accessed through the internet. On-premise solutions, on the other hand, are installed on the company’s own servers.

Cloud-Based Solutions

- Advantages:

- Accessible from anywhere with an internet connection

- Automatic updates and backups

- Lower upfront costs than on-premise solutions

- Disadvantages:

- Reliance on internet connectivity

- Potential security concerns

- Limited customization options

On-Premise Solutions

- Advantages:

- Greater control over data and security

- More customization options

- Potential for better performance

- Disadvantages:

- Higher upfront costs than cloud-based solutions

- Manual updates and backups required

- May require additional IT support

Features to Consider When Choosing Software

Selecting the right accounting and inventory software for your small business is crucial for efficient operations and accurate financial management. Here’s a comprehensive list of features to consider:

Essential Features:

- Invoicing: Create and send professional invoices with ease, track payments, and manage customer accounts.

- Expense Tracking: Record and categorize expenses, attach receipts, and generate expense reports for tax purposes.

- Inventory Management: Keep track of inventory levels, set reorder points, and generate inventory reports for better stock control.

- Reporting: Generate financial reports such as profit and loss statements, balance sheets, and cash flow statements for analysis and decision-making.

Additional Features:

- Payroll Management: Manage employee payroll, calculate deductions, and file payroll taxes.

- Project Management: Track project progress, manage tasks, and allocate resources.

- Bank Reconciliation: Import bank statements and reconcile transactions automatically.

- Cloud-Based Access: Access your software from anywhere with an internet connection.

- Mobile App: Manage your finances on the go with a mobile app.

Integration with Other Business Systems

Integrating accounting and inventory software with other business systems is crucial for streamlined operations and efficient data management. Seamless data flow between systems eliminates manual data entry, reduces errors, and provides a comprehensive view of business performance.

Common integrations include:

Customer Relationship Management (CRM)

- Syncs customer data, such as contact information, purchase history, and preferences.

- Enables targeted marketing campaigns and improved customer service.

E-commerce

- Automates order processing, inventory updates, and shipping information.

- Improves order fulfillment and reduces processing time.

Payment Gateways, Accounting and inventory software for small business

- Securely processes online payments.

- Reconciles payments with accounting records and automates invoice generation.

Implementation and Training

Implementing accounting and inventory software involves several key steps:

- Planning: Determine business needs, software requirements, and implementation timeline.

- Data migration: Transfer existing accounting and inventory data into the new software.

- Configuration: Customize the software to align with specific business processes.

- Testing: Conduct thorough testing to ensure the software functions correctly.

- Go-live: Deploy the software and begin using it for daily operations.

Tips for Successful Implementation

- Involve key stakeholders in the planning and implementation process.

- Provide clear and comprehensive training to users.

- Set realistic expectations and timelines.

- Monitor progress and make adjustments as needed.

- Seek professional support from software vendors or consultants if necessary.

Importance of Training and Support

Effective training empowers users to utilize the software efficiently and accurately. Support ensures that users have access to assistance when needed, fostering user adoption and maximizing software value.

Security and Compliance

In today’s digital age, ensuring the security and compliance of accounting and inventory software is paramount. Data breaches and privacy concerns pose significant risks to businesses, making it crucial to implement robust measures to protect sensitive information.

Best practices for data protection and privacy include:

- Encryption of data both at rest and in transit

- Regular software updates to patch security vulnerabilities

- Access controls to restrict user permissions

- Data backup and disaster recovery plans

- Employee training on data security best practices

Accounting and inventory software can also assist businesses in complying with regulatory requirements, such as:

- General Data Protection Regulation (GDPR)

- Sarbanes-Oxley Act (SOX)

- Payment Card Industry Data Security Standard (PCI DSS)

By choosing software that adheres to industry standards and best practices, businesses can mitigate risks, protect sensitive information, and maintain compliance with regulations.

Pricing and Support

Understanding the pricing models and support options for accounting and inventory software is crucial for small businesses. Different vendors offer varying pricing structures and support levels, and choosing the right option depends on your specific needs and budget.

Pricing models typically include subscription-based plans, one-time purchases, or a combination of both. Subscription plans offer monthly or annual fees that provide access to software updates and support. One-time purchases involve a single payment for the software, but may not include ongoing support or updates.

Levels of Support

- Basic support: Typically included with the software purchase, this level provides limited support through email or phone.

- Standard support: Offers extended support hours, priority response times, and access to online resources.

- Premium support: Provides dedicated support personnel, 24/7 availability, and advanced troubleshooting assistance.

Consider factors such as the size of your business, the complexity of your accounting and inventory needs, and your budget when evaluating pricing and support options. Choose a vendor that offers a pricing model and support level that aligns with your requirements.

Case Studies and Success Stories

Real-world examples and success stories of small businesses that have successfully implemented accounting and inventory software offer valuable insights into the benefits and impact of these solutions.

By examining case studies, you can witness firsthand how software has transformed operations, enhanced profitability, and empowered businesses to achieve their goals.

Benefits Experienced by Small Businesses

- Improved accuracy and efficiency: Software automates tasks, reducing errors and saving time.

- Enhanced visibility and control: Real-time access to data provides better insights into finances and inventory.

- Increased profitability: Optimized inventory management and cost tracking lead to increased margins.

- Improved customer satisfaction: Accurate and timely invoicing and inventory availability enhance customer experiences.

- Scalability and growth: Software supports business growth by streamlining processes and providing scalability.

Ultimate Conclusion

In the realm of small businesses, accounting and inventory software emerges as an indispensable ally, empowering entrepreneurs to streamline operations, optimize inventory management, and gain invaluable insights into their financial performance. By embracing this technological marvel, small businesses can unlock a world of efficiency, accuracy, and growth, propelling them towards success in today’s competitive market landscape.

User Queries

What are the key benefits of accounting and inventory software for small businesses?

Accounting and inventory software streamlines financial management, automates inventory tracking, enhances accuracy, saves time, and provides valuable insights for informed decision-making.

How do I choose the right accounting and inventory software for my business?

Consider your business size, industry, specific needs, budget, and ease of use. Evaluate features such as invoicing, expense tracking, inventory management, reporting, and integration capabilities.

What is cloud-based accounting and inventory software?

Cloud-based software is hosted online, allowing access from anywhere with an internet connection. It eliminates the need for local installation and maintenance, ensuring automatic updates and data security.