As accounting software for small business with inventory takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Accounting software has become indispensable for small businesses looking to streamline their financial processes and gain a competitive edge. With its robust features and inventory management capabilities, accounting software empowers small businesses to make informed decisions, improve efficiency, and ultimately drive growth.

Small Business Accounting Software Features: Accounting Software For Small Business With Inventory

Small business accounting software is designed to streamline and simplify financial management tasks for small businesses. It offers a range of essential features tailored to the specific needs of small businesses, including:

- Income and Expense Tracking: Allows businesses to record and categorize all income and expenses, providing a clear overview of financial transactions.

- Invoicing and Billing: Enables businesses to create and send professional invoices, track payments, and manage customer accounts.

- Bank Reconciliation: Helps businesses match transactions in their accounting software with their bank statements, ensuring accuracy and preventing errors.

- Financial Reporting: Provides customizable reports, such as profit and loss statements, balance sheets, and cash flow statements, offering insights into financial performance.

- Tax Management: Assists businesses in calculating and filing taxes, reducing the risk of errors and ensuring compliance with tax regulations.

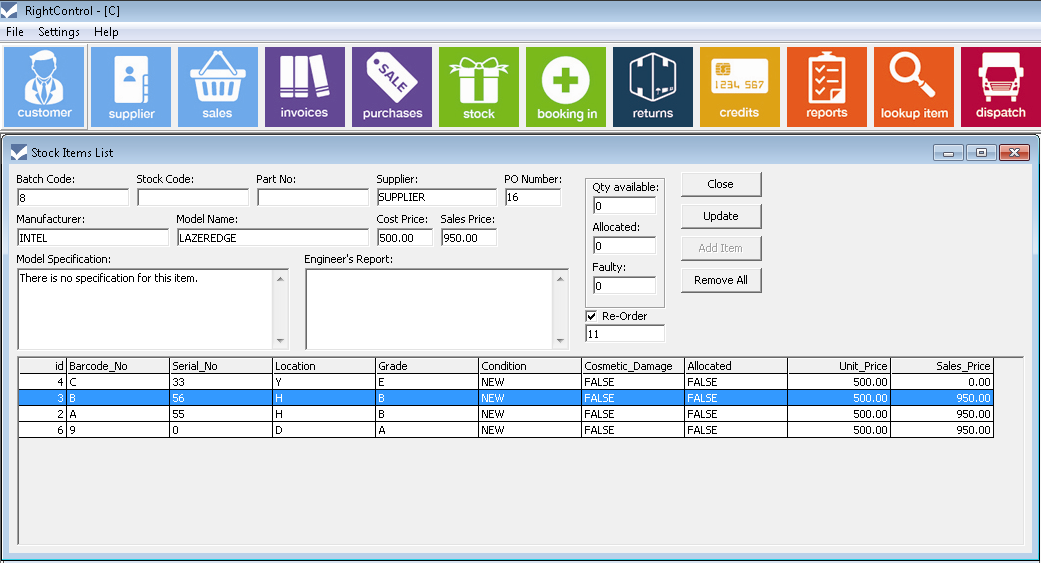

Inventory Management Capabilities

Inventory management is a crucial aspect of accounting for small businesses, particularly those dealing with physical products. Effective inventory management helps businesses:

- Track Stock Levels: Monitor the quantity and value of inventory items in real-time, preventing stockouts and overstocking.

- Manage Costs: Calculate the cost of goods sold (COGS) accurately, optimizing inventory levels and minimizing losses.

- Improve Efficiency: Automate inventory processes, such as order fulfillment and reordering, saving time and reducing errors.

- Enhance Customer Service: Provide accurate and up-to-date information on product availability, improving customer satisfaction and reducing order cancellations.

Benefits of Using Accounting Software for Small Businesses

Leveraging accounting software can empower small businesses with numerous advantages that can streamline their financial operations and propel their growth. These benefits include enhanced accuracy, efficiency, and time savings, allowing businesses to allocate more resources to core activities that drive revenue and success.

Improved Accuracy

Manual accounting processes are prone to errors due to human oversight. Accounting software eliminates this risk by automating calculations, reducing the likelihood of mistakes and ensuring the accuracy of financial data. This reliability empowers businesses to make informed decisions based on accurate financial insights.

Increased Efficiency

Accounting software streamlines financial processes, eliminating the need for manual data entry and reconciliation. This automation saves time and effort, allowing businesses to focus on more strategic tasks. By automating repetitive tasks, accounting software enables businesses to process transactions faster and generate reports more efficiently.

Time Savings

The time saved by using accounting software is substantial. Businesses can reduce the time spent on bookkeeping, invoicing, and other financial tasks by up to 70%. This time can be reinvested in activities that directly contribute to business growth, such as sales, marketing, and product development.

Types of Accounting Software for Small Businesses

Selecting the appropriate accounting software is crucial for small businesses to manage their financial data effectively. There are various types of accounting software available, each with its own advantages and disadvantages. Understanding the different types can help small businesses make informed decisions when choosing the right software for their specific needs.

The primary types of accounting software for small businesses include cloud-based, desktop-based, and mobile-based software.

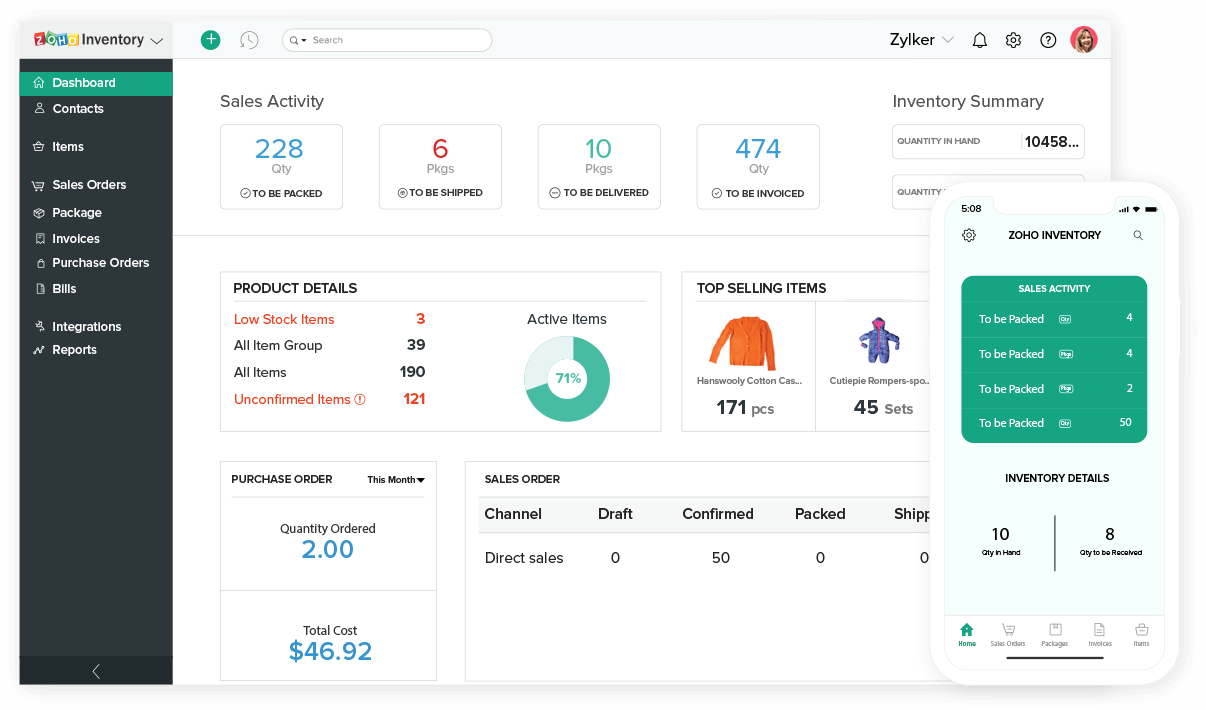

Cloud-Based Accounting Software, Accounting software for small business with inventory

Cloud-based accounting software, also known as Software as a Service (SaaS), is hosted on remote servers and accessible via the internet. This type of software offers several advantages:

- Accessibility: Cloud-based software can be accessed from any device with an internet connection, allowing for remote work and collaboration.

- Automatic Updates: The software provider handles updates and maintenance, ensuring the latest features and security patches are always available.

- Scalability: Cloud-based software can easily scale up or down as a business grows or changes.

However, cloud-based software also has some disadvantages:

- Internet Dependence: An internet connection is required to access the software, which can be a limitation in areas with poor or unstable internet connectivity.

- Data Security: While cloud-based software providers typically implement security measures, businesses must trust the provider to protect their sensitive financial data.

Desktop-Based Accounting Software

Desktop-based accounting software is installed on a local computer or server. This type of software offers the following advantages:

- Control: Businesses have complete control over their data, as it is stored locally on their own hardware.

- Customization: Desktop-based software can be customized to meet specific business needs.

- Cost: Desktop-based software typically has a lower upfront cost compared to cloud-based software.

However, desktop-based software also has some disadvantages:

- Limited Accessibility: The software can only be accessed from the computer or server where it is installed.

- Maintenance: Businesses are responsible for software updates, maintenance, and data backups.

- Scalability: Scaling up desktop-based software can be more challenging and expensive than cloud-based software.

Mobile-Based Accounting Software

Mobile-based accounting software is designed for use on smartphones and tablets. This type of software offers the following advantages:

- Convenience: Mobile-based software allows businesses to manage their finances on the go.

- Real-Time Access: Businesses can access their financial data and make updates in real-time.

- Integration: Mobile-based software can be integrated with other business apps, such as CRM and inventory management systems.

However, mobile-based software also has some disadvantages:

- Limited Functionality: Mobile-based software may have limited functionality compared to desktop-based or cloud-based software.

- Security: Businesses need to ensure that their mobile devices are secure to protect their financial data.

- Data Entry: Data entry on mobile devices can be more time-consuming than on larger screens.

Factors to Consider When Choosing Accounting Software

When choosing accounting software for a small business, several factors should be considered:

- Business Size and Complexity: The size and complexity of the business will determine the features and functionality required in the software.

- Budget: The cost of the software, including upfront costs, subscription fees, and maintenance costs, should be considered.

- User-Friendliness: The software should be easy to use and navigate, especially for non-accountants.

- Integration: The ability to integrate the software with other business systems, such as CRM, inventory management, and e-commerce platforms, is important.

- Technical Support: The availability and quality of technical support from the software provider should be considered.

Best Practices for Using Accounting Software for Small Businesses

Effective use of accounting software is crucial for small businesses to streamline financial operations, ensure accuracy, and make informed decisions. Here are some best practices to maximize the benefits of accounting software:

Setting Up the Software

- Customize the software to suit your business’s specific needs.

- Set up a chart of accounts that aligns with your business structure.

- Establish a process for recording transactions consistently.

- Integrate the software with other business applications, such as CRM or e-commerce platforms.

Maintaining Accurate Records

- Record all financial transactions promptly and accurately.

- Use a double-entry accounting system to ensure data integrity.

- Reconcile bank statements regularly to identify and correct any discrepancies.

- Review financial reports regularly to identify trends and potential issues.

Generating Reports

- Utilize the software’s reporting capabilities to generate financial statements, such as balance sheets, income statements, and cash flow statements.

- Use reports to track financial performance, identify areas for improvement, and make informed decisions.

- Customize reports to meet specific business needs and generate tailored insights.

Using Accounting Software for Financial Decision-Making

- Use financial reports to analyze business performance and identify opportunities for growth.

- Utilize budgeting tools to plan and forecast financial activities.

- Monitor cash flow to ensure sufficient liquidity and prevent financial distress.

- Leverage accounting data to make informed decisions about investments, expenses, and pricing.

Common Challenges in Using Accounting Software for Small Businesses

While accounting software offers numerous benefits, small businesses may encounter certain challenges during implementation and usage. These challenges can range from lack of training to integration issues, potentially hindering the software’s effectiveness.

To address these challenges, it’s crucial to identify common obstacles and explore potential solutions. This proactive approach ensures small businesses can maximize the benefits of accounting software and streamline their financial management processes.

Training and Support

Inadequate training can lead to incorrect data entry, inefficient use of features, and a lack of understanding of the software’s capabilities. To overcome this challenge, businesses should invest in comprehensive training programs that cater to the specific needs of their staff.

Additionally, ongoing support from the software provider is essential to ensure that users have access to timely assistance and resources when needed. This can include technical support, documentation, and access to online forums or communities.

Integration with Other Systems

Accounting software should seamlessly integrate with other business systems, such as inventory management, customer relationship management (CRM), and payroll systems. Poor integration can result in data duplication, errors, and inefficiencies.

To address this challenge, businesses should carefully evaluate the compatibility of the accounting software with their existing systems before implementation. Additionally, they should consider using software that offers open APIs or integration capabilities to facilitate seamless data exchange.

Data Security

Small businesses often handle sensitive financial data, making data security a paramount concern. Accounting software should employ robust security measures to protect against unauthorized access, data breaches, and cyber threats.

Businesses should ensure that the software they choose complies with industry-standard security protocols and provides features such as encryption, multi-factor authentication, and regular security updates.

Cost and Budget Constraints

Accounting software can vary significantly in cost, depending on the features, functionality, and support options offered. Small businesses may face challenges in finding software that fits within their budget while meeting their specific requirements.

To address this challenge, businesses should carefully evaluate their needs and prioritize the features that are most important to their operations. They should also consider exploring open-source or cloud-based software options that may offer cost-effective solutions.

Time and Resources

Implementing and using accounting software requires time and resources, which can be a challenge for small businesses with limited staff and resources.

To overcome this challenge, businesses should carefully plan the implementation process and allocate sufficient time for training and onboarding. They should also consider outsourcing certain accounting tasks or seeking assistance from a qualified accountant to supplement their internal resources.

Future Trends in Accounting Software for Small Businesses

The future of accounting software for small businesses is bright, with many exciting trends emerging. These trends will make it easier for small businesses to manage their finances, save time, and make better decisions.

One of the most important trends is the rise of artificial intelligence (AI). AI can be used to automate many accounting tasks, such as data entry, invoice processing, and financial reporting. This can free up small business owners to focus on more strategic tasks, such as growing their business.

Machine Learning

Machine learning is a type of AI that allows computers to learn from data without being explicitly programmed. This can be used to improve the accuracy and efficiency of accounting software. For example, machine learning can be used to identify and correct errors in data entry, and to predict future cash flow.

Data Analytics

Data analytics is the process of using data to make better decisions. Accounting software can be used to collect and analyze data on a business’s financial performance. This data can be used to identify trends, spot opportunities, and make better decisions about how to allocate resources.

Small businesses that are able to embrace these trends will be well-positioned to succeed in the future. By using accounting software that is powered by AI, machine learning, and data analytics, small businesses can save time, improve their accuracy, and make better decisions.

Closure

In conclusion, accounting software for small business with inventory is an invaluable tool that can transform financial management. By leveraging its advanced features and inventory management capabilities, small businesses can unlock a world of possibilities, paving the way for financial success and sustainable growth.

Detailed FAQs

What are the key features of accounting software for small businesses?

Accounting software for small businesses typically includes features such as invoicing, expense tracking, financial reporting, inventory management, and tax calculation.

How can accounting software help small businesses save time?

Accounting software automates many manual tasks, such as data entry and report generation, freeing up valuable time for small business owners to focus on other aspects of their business.

What are the benefits of using cloud-based accounting software?

Cloud-based accounting software offers benefits such as accessibility from anywhere with an internet connection, automatic updates, and enhanced collaboration.