Small business accounting and inventory software is a game-changer for businesses looking to streamline their operations, enhance efficiency, and gain a competitive edge. This comprehensive guide will delve into the world of accounting and inventory software, providing valuable insights and practical advice to help you make informed decisions for your business.

From understanding the basics to implementing and managing software effectively, this guide covers everything you need to know about small business accounting and inventory software. So, let’s dive in and explore how this powerful tool can transform your business.

Understanding Small Business Accounting and Inventory Software

Small businesses need efficient ways to manage their financial and inventory operations. Accounting and inventory software can help streamline these processes, providing valuable insights and improving overall business performance.

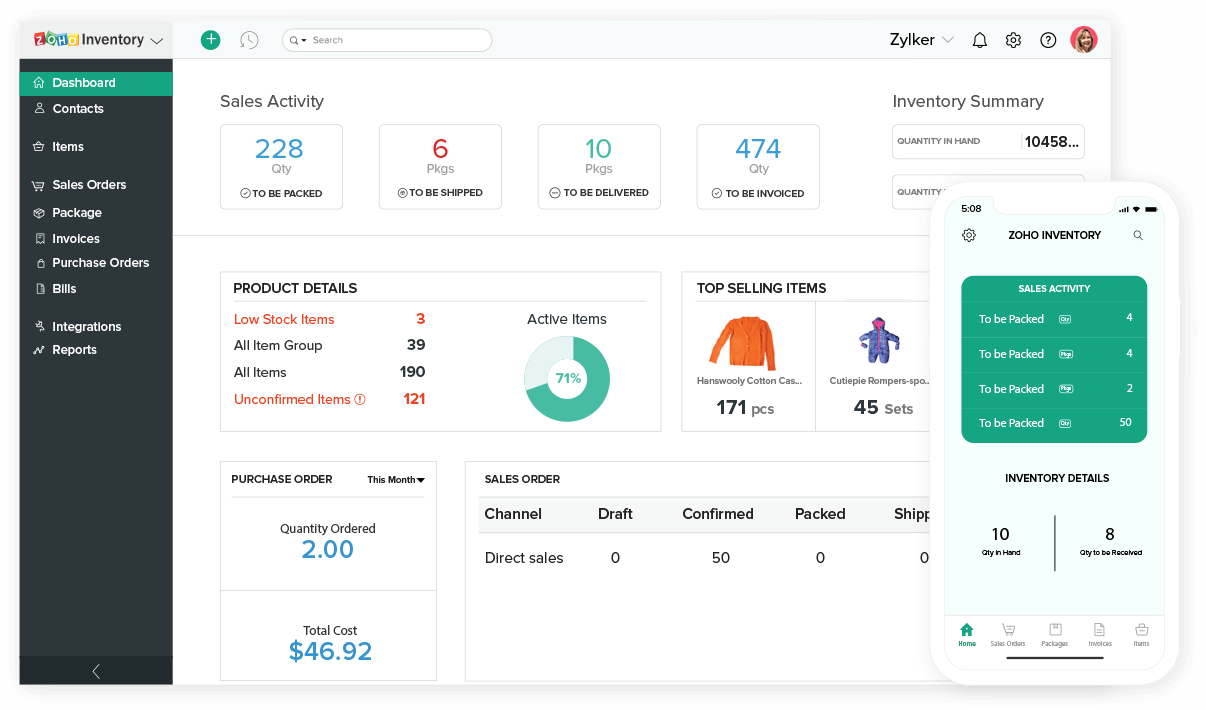

Accounting software automates tasks such as invoicing, expense tracking, and financial reporting. Inventory software tracks stock levels, manages orders, and provides insights into sales patterns. By integrating these functions, small businesses can gain a comprehensive view of their financial and inventory data.

Benefits of Using Accounting and Inventory Software

- Improved accuracy: Software eliminates manual errors, ensuring accurate financial and inventory records.

- Increased efficiency: Automation saves time and reduces the workload, allowing businesses to focus on other areas.

- Enhanced insights: Reports and analytics provide valuable insights into business performance, helping owners make informed decisions.

- Better compliance: Software helps businesses stay compliant with tax and regulatory requirements.

- Improved customer service: Real-time inventory tracking enables businesses to fulfill orders accurately and respond promptly to customer inquiries.

Common Features of Accounting and Inventory Software

- Invoicing and billing: Create and send invoices, track payments, and manage customer accounts.

- Expense tracking: Record and categorize expenses, generate expense reports, and monitor budgets.

- Inventory management: Track stock levels, set reorder points, and generate inventory reports.

- Order processing: Manage orders, track shipments, and update inventory levels.

- Financial reporting: Generate financial statements, such as balance sheets, income statements, and cash flow statements.

Key Considerations for Selecting Software

Choosing the right accounting and inventory software is crucial for streamlining your business operations. Consider the following factors when making your decision:

Scalability: As your business grows, your software should be able to adapt to your increasing needs. Ensure it can handle larger volumes of data and support additional users.

Ease of Use: The software should be user-friendly, allowing your team to navigate and perform tasks efficiently. A clear and intuitive interface is essential.

Integration with Other Business Systems: Consider how the software integrates with your existing systems, such as CRM or ERP. Seamless integration can streamline processes and improve data accuracy.

Evaluating Software Solutions

To evaluate software solutions effectively, follow these tips:

- Identify Your Business Needs: Determine the specific features and functionality you require to meet your business objectives.

- Research and Compare Options: Explore different software providers, read reviews, and compare their offerings to find the best fit for your needs.

- Request Demos and Trial Versions: Experience the software firsthand by requesting demos or utilizing trial versions to assess its usability and functionality.

- Consider Support and Maintenance: Evaluate the provider’s customer support and maintenance offerings to ensure they align with your expectations.

- Seek Expert Advice: If necessary, consult with an accountant or IT professional to gain insights and recommendations.

Implementation and Management of Software

Implementing and managing accounting and inventory software is crucial for businesses to streamline operations, improve accuracy, and enhance efficiency. This section provides a comprehensive guide to the implementation process, best practices for training and data accuracy, and ongoing maintenance and updates for the software.

Steps Involved in Implementing Accounting and Inventory Software

- Assessment and Planning: Determine the specific business needs, goals, and processes to be automated. Conduct a thorough evaluation of available software options based on functionality, cost, and scalability.

- Data Migration and Integration: Import existing accounting and inventory data into the new software. Ensure seamless integration with other business systems, such as CRM or ERP, to avoid data silos and maintain consistency.

- Configuration and Customization: Configure the software to align with the specific business processes and requirements. Customize fields, reports, and workflows to optimize functionality and meet unique needs.

- Training and User Adoption: Provide comprehensive training to staff on the software’s features, functionality, and best practices. Encourage user adoption through ongoing support and feedback mechanisms.

- Testing and Deployment: Conduct thorough testing to ensure the software functions as expected and meets business requirements. Deploy the software in a controlled environment to minimize disruptions and ensure a smooth transition.

Best Practices for Training Staff and Ensuring Data Accuracy

Effective training is essential for successful software implementation. Provide clear and concise training materials, hands-on exercises, and real-life scenarios to enhance understanding and retention. Establish clear guidelines for data entry and validation to maintain data accuracy and integrity.

Ongoing Maintenance and Updates for the Software

- Regular Updates: Install software updates and patches promptly to address security vulnerabilities, bug fixes, and new features. Schedule updates during non-peak hours to minimize business interruptions.

- Data Backups: Regularly back up accounting and inventory data to protect against data loss due to hardware failure, software glitches, or cyberattacks. Implement a robust backup strategy to ensure data recovery in case of emergencies.

- Technical Support: Establish a reliable technical support system to address any issues or questions that arise during software usage. Utilize online resources, documentation, or dedicated support channels to provide timely assistance.

Specific Features for Small Businesses

Small businesses have unique accounting and inventory needs that differ from larger enterprises. Specialized software can streamline operations, improve efficiency, and enhance profitability.

Key features tailored to small businesses include:

Invoicing

Automated invoicing streamlines billing, reducing errors and saving time. Features like customizable templates, payment tracking, and online payment options simplify the invoicing process.

Expense Tracking

Expense tracking software allows businesses to capture and categorize expenses accurately. This provides real-time visibility into spending, enabling better budgeting and cost control.

Inventory Management

Inventory management features help businesses track stock levels, optimize inventory turnover, and reduce waste. Automated inventory tracking eliminates manual counting errors, ensures accurate stock levels, and prevents overstocking or stockouts.

Integration with Other Business Systems

Integrating accounting and inventory software with other business systems is crucial for streamlining operations and enhancing data flow. By connecting with CRM, e-commerce platforms, and payment gateways, businesses can automate processes, improve data accuracy, and gain a comprehensive view of their operations.

CRM Integration

Integrating with a CRM system enables real-time updates of customer information, such as contact details, purchase history, and support interactions. This allows for personalized marketing campaigns, improved customer service, and better sales forecasting.

E-commerce Integration

Integrating with an e-commerce platform automates order processing, inventory management, and payment reconciliation. This eliminates manual data entry, reduces errors, and provides real-time updates on stock levels and order status.

Payment Gateway Integration

Integrating with a payment gateway allows for secure and efficient payment processing. This reduces fraud risk, streamlines reconciliation, and provides customers with a convenient and secure checkout experience.

Security and Data Management

In the realm of accounting and inventory software, safeguarding sensitive financial and customer information is paramount. Effective data security measures ensure the integrity, confidentiality, and availability of crucial business data, protecting against unauthorized access, breaches, and data loss.

Best Practices for Data Protection, Small business accounting and inventory software

- Implement strong passwords and enforce regular password changes.

- Utilize encryption to protect data at rest and in transit.

- Limit access to sensitive data on a need-to-know basis.

- Regularly monitor system activity for suspicious behavior.

- Conduct security audits to identify vulnerabilities and address risks.

Data Backup and Recovery

Data backup and recovery strategies are essential for protecting against data loss due to hardware failures, software malfunctions, or malicious attacks. Consider:

- Regular backups to multiple secure locations.

- Testing backup procedures to ensure data integrity and recoverability.

- Storing backups offline to protect against cyberattacks.

Compliance with Industry Regulations

Adhering to industry regulations, such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR), is crucial for ensuring compliance and protecting customer data. Review:

- Industry-specific security standards and regulations.

- Implement measures to meet compliance requirements.

- Stay updated on regulatory changes to maintain compliance.

Final Wrap-Up

In conclusion, small business accounting and inventory software is an indispensable tool for businesses seeking growth and efficiency. By carefully considering your needs, implementing the software effectively, and leveraging its specialized features, you can streamline your operations, improve accuracy, and gain valuable insights into your business performance. Embrace the power of accounting and inventory software today and unlock the potential for success.

Essential FAQs: Small Business Accounting And Inventory Software

What are the key benefits of using small business accounting and inventory software?

Small business accounting and inventory software offers numerous benefits, including improved accuracy, streamlined operations, enhanced efficiency, reduced costs, and better decision-making.

How do I choose the right accounting and inventory software for my business?

Consider factors such as the size of your business, industry, specific needs, ease of use, scalability, integration capabilities, and customer support when selecting accounting and inventory software.

What are some common features of small business accounting and inventory software?

Common features include invoicing, expense tracking, inventory management, financial reporting, tax calculations, and integration with other business systems.